They have graced the windscreens of cars for almost 100 years, but with police now able to use number plate-reading cameras to access driver and vehicle details, the paper tax disc has, from today (1 October 2014) been consigned to history.

Can I remove my tax disc even if it has yet to expire?

Yes. Motorists still need to pay for vehicle excise duty, but the entire system is now electronic rendering the paper disc obselete, even if has yet to expire. Drivers with a valid tax disc can remove it from their windscreen and remain covered. When time comes to renew, they will renew in the usual way or pay for the VED via a monthly direct debit (subject to a 5% surcharge).

From today, when a vehicle is sold, the VED is not transferable as it was with the paper disc. For more information about the new system of VED, visit https://www.gov.uk/browse/driving/car-tax-discs

End of an era

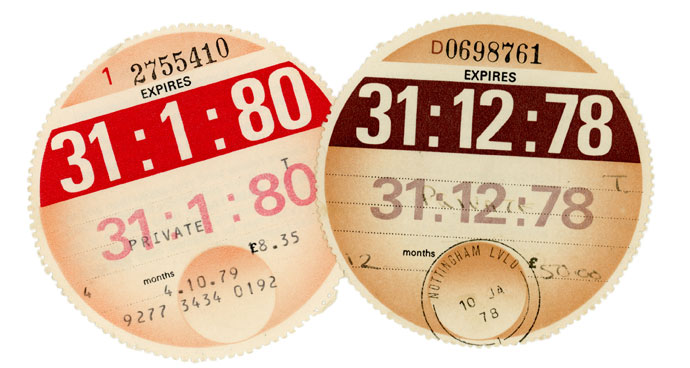

The paper tax disc may go more or less unnoticed day to day, but it is no less an example of transport iconography as the Routemaster bus, London taxi or underground map. Its design, which boasts the perforated edges of a stamp and the watermarks and embossing akin to a banknote, makes the tax disc a far more evocative piece of car culture than, say, the modern-day driving license, MOT or car registration document. Such is the fascination with the paper disc by some that it has a name; Velology is the study and collection of vehicle tax discs. The word was created by combining the acronym VEL (vehicle excise licence) and -ology. Collectors are known as velologists.

How much will I pay under new electronic VED system?

To work out how much vehicle excise duty (commonly referred to as car tax or road tax) you will pay for your car from 1 April 2014, you need to know how much CO2 it emits. You can find this on your vehicle’s V5C registration certificate (log book) or new keeper details section (V5C/2). Motorists opting to pay by direct debit will be subject to a 5% surcharge on the rates below. To renew your vehicle tax under the new system, visit the DVLA website.

Rates of vehicle tax for petrol and diesel cars registered on, or after, 1 March 2001

| Band | CO2 emissions | 2014-15 | 2014-15 6 months | |

|---|---|---|---|---|

| A | up to 100g/km | £0 | not available | |

| B | 101-110g/km | £20 | not available | |

| C | 111-120g/km | £30 | not available | |

| D | 121-130g/km | £110 | £60.50 | |

| E | 131-140g/km | £130 | £71.50 | |

| F | 141-150g/km | £145 | £79.75 | |

| G | 151-160g/km | £180 | £99.00 | |

| H | 161-170g/km | £205 | £112.75 | |

| I | 171-180g/km | £225 | £123.75 | |

| J | 181-200g/km | £265 | £145.75 | |

| K* | 201-225g/km | £285 | £156.75 | |

| L | 226-255g/km | £485 | £266.75 | |

| M | over 255g/km | £500 | £275.00 |

* Band K includes cars that have a CO2 emission figure over 225g/km but were registered before 23 March 2006.

0 Comments View now