How much do you know about your car insurance provider? Are they attentive – perhaps friendly? Do they entice you with offers such as free car breakdown cover? With a lucrative pool of 30 million cars requiring insurance it’s likely they do, but have you stopped to consider how some insurers are able to keep premiums low and sales incentives so generous?

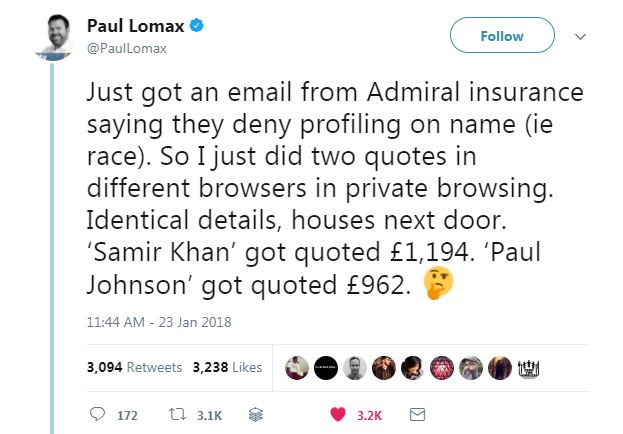

Admiral was one of a number of car insures this week embroiled in allegations of racial profiling – journalists uncovered that drivers with an Arabic name were being charged hundreds of pounds more than other customers identical in all but name.

Racial profiling is downright illegal, but what about immoral behaviour by insurance companies?

Churchill may have a friendly looking British Bulldog as its mascot, but it seems the beast is as likely to snarl rabidly as it is to chortle if the legal case brought by the insurance giant in 2013 is anything to go by.

In a bid, one assumes, to protect its bottom line on behalf of its customers, Churchill insurance appealed against the High Court ruling that ordered it pay £5m compensation to a 13-year-old girl who was left brain-damaged after she was run over by one of its customer who was speeding at the time.

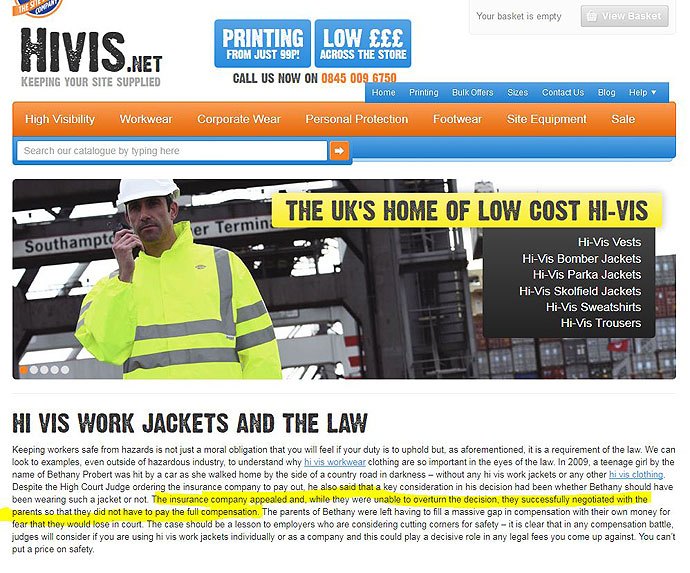

Bethany Probert was walking on a grass verge when she was struck by the car, but the insurer claimed she was partly to blame because she was not wearing a high-visibility jacket at the time.

When the case was heard in the High Court, the judge ruled that the insurance company was 100 per cent liable because the driver was speeding. However, the Court of Appeal allowed the insurers to appeal against the original ruling. The plan, it seemed, was for Churchill’s lawyers plan to tell the court Bethany should have known to wear reflective clothing because she was an experienced horse rider.

At the time the Churchill insurance spokesperson said: “While we accept that our insured was liable in part for the accident, we are appealing the decision that he was entirely to blame.”

Had the appeal been heard, the test case would have decided to what extent children can be held responsible for their injuries in road crashes. However, as is often the case, and completely understandably given what they had already endured, Bethany’s parents decided to accept a reduced out-of-court settlement.

The squalid behaviour by Churchill has inspired high-vis suppliers to cite the legal case in their advertising…just one of the ways that apathy towards road danger and victim blaming becomes institutionalised.

Not in my name

If you have car insurance with Churchill or any other providers with morally-questionable business practices (Admiral has been called out in the press this week following allegations of racial profiling), and you object, move your custom…but don’t forget to let them know why you are leaving.

Strict liability

Road safety campaigners in Britain have long campaigned for strict liability – a principle that makes motorists financially liable for collisions with pedestrians or cyclists. Only when the pedestrian or cyclist was proved to be grossly negligent would the driver avoid paying compensation through their insurance. Strict liability recognises that the drivers of faster, heavier vehicles have a duty of care and that if a pedestrian or cyclist is injured in a road traffic collision it can be difficult for them to accurately recollect the event. Under this system, the case put by Churchill would be considered sharp practice.

The case of Churchill vs Probert is not a nightmarish Orwellian vision it is happening today. In allowing the car to take such precedence in our society we have sleep walked into blaming our children when they are run over.

Churchill appeared not to recognise its decision to appeal as immoral, so the responsibility for such action must pass, at least in part, to its customers and and all of us who drive; everyone wants to save money on their car insurance, but if this case leaves a bitter taste in your mouth, take action. If you are a customer of Churchill, ask them to account for themselves. It would be interesting to know if any other car insurer would have behaved differently.

Your journey, our world

The ETA has been rated ethical in Britain for the second year running by the Good Shopping Guide.

The ETA was established in 1990 as an ethical provider of green, reliable travel services. Twenty six years on, it continues to offer cycle insurance, travel insurance and breakdown cover while putting concern for the environment at the heart of all it does.

0 Comments View now